Policy Options for Reducing CO2 Emissions

February 2008

There is a growing scientific consensus that rising concentrations of carbon dioxide (CO2) and other greenhouse gases, which result from the burning of fossil fuels, are gradually warming the Earth’s climate. The amount of damage associated with that warming remains uncertain, but there is some risk that it could be large and perhaps even catastrophic. Reducing that risk would require restraining the growth of CO2 emissions—and ultimately limiting those emissions to a level that would stabilize atmospheric concentrations—which would involve costs that are also uncertain but could be substantial.

The most efficient approaches to reducing emissions of CO2involve giving businesses and households an economic incentive for such reductions. Such an incentive could be provided in various ways, including a tax on emissions, a cap on the total annual level ofemissions combined with a system of tradable emission allowances, or a modified cap-and-trade program that includes features to constrain the cost of emission reductions that would be undertaken in an effort to meet the cap. This Congressional Budget Office (CBO) study—prepared at the request of the Chairman of the Senate Committee on Energy and Natural Resources—compares those policy options on the basis of three key criteria: their potential to reduce emissions efficiently, to be implemented with relatively low administrative costs, and to create incentives for emission reductions that are consistent with incentives in other countries. In keeping with CBO’s mandate to provide objective, impartial analysis, the report contains no recommendations.

The study was written by Terry Dinan of CBO’s Microeconomic Studies Division under the guidance of Joseph Kile and David Moore. Robert Dennis, Douglas Hamilton, Robert Shackleton, and Thomas Woodward provided comments. Outside CBO, William Pizer of Resources for the Future, Reid Harvey of the Environmental Protection Agency, and Martin Weitzman of Harvard University provided comments. (The assistance of external reviewers implies no responsibility for the final product, which rests solely with CBO.)

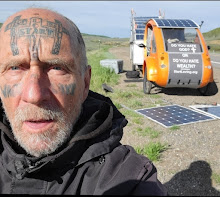

Christine Bogusz and Christian Howlett edited the study, Sherry Snyder proofread it, and Angela McCollough prepared the final draft of the manuscript. Maureen Costantino prepared the study for publication, designed the cover, and took the photograph of the traffic on the cover. Lenny Skutnik printed copies of the study, Linda Schimmel handled the distribution, and Simone Thomas prepared the electronic version for CBO’s Web site.

Peter R. Orszag

Director

February 2008

Contents

Efficiency Implications of Different Policy Designs

A Carbon Dioxide Tax Versus an Inflexible Carbon Dioxide Cap

Implementation Considerations for Different Policy Designs

A Carbon Dioxide Tax Versus an Inflexible Carbon Dioxide Cap

International Consistency Considerations for Different Policy Designs

A Carbon Dioxide Tax Versus an Inflexible Carbon Dioxide Cap

Current and Proposed Cap-and-Trade Programs in the United States and Europe

S-1. Comparison of Selected Policies for Cutting CO2 Emissions

1-1. Illustrative Comparison of Various Policies to Reduce CO2 Emissions Under Different Cost Conditions

1-3. Volatility of SO2 Allowance Prices and Selected Other Prices, 1995 to 2006